Texas

Texas's Veteran Benefits

Are you a veteran or current servicemember residing or stationed in Texas? There are a lot of state benefits available as a "thank you" for your service.

These benefits exist to help those who have served their country—and who because of that service may need some help from the country.

If you need help understanding these benefits, or how to use them, the Texas Veterans Commission has agents who can help.

On this page, we've tried to cover and explain some of the most important programs and services you can get while you're in Texas, including help with tuition, VA loans, health care advocacy, assistance grants, free licenses, resources to help find jobs, and many others.

Texas Residents Save

$182/mth

Savings based on 2015 active loan data

78Gallons of gas

*Price-per-gallon based on CNN Money

22Lunches

*Based on an average lunch price of $8.08

Veteran Home Loans

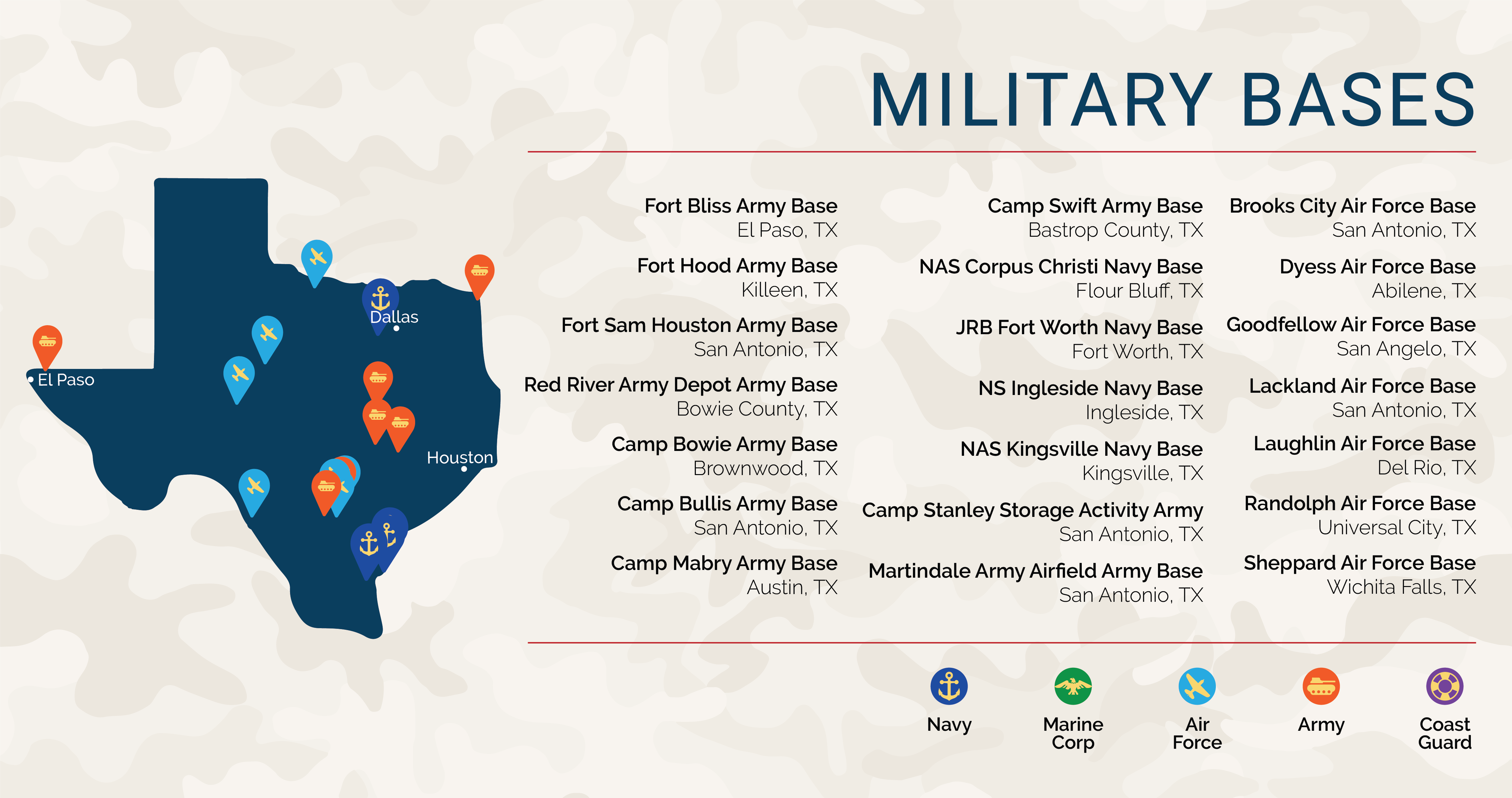

If you're stationed in Texas with the Army, Air Force, Navy, or Coast Guard, you might think about buying your own house. With veteran home loans in Texas, becoming a homeowner is less expensive than with other loan types.

In order to enjoy the convenience of living near where you work, you could start your search for a home near one of the military bases in Texas.

Buying a house in Texas can be simple for both military personnel and veterans if you use a VA loan. VA loans are a type of mortgage that offers great features like:

- No down payment required on home purchases

- No minimum credit score required to be eligible

- No required private mortgage insurance (PMI)

- Lower interest rates than are offered on many mortgage types

Private lenders who offer VA loans must follow the VA's guidelines, and the VA gives guarantees to those lenders to help them offer you great terms. How much your loan gets approved for depends on your financial history and current situation.

In order to get the best loan for you, we recommend that you talk to a few lenders about the VA loan rates and terms they can offer. Since you'll be paying on this mortgage for years, you'll want to get the best terms you can.

We hope you'll consider us as one of your potential lenders. To get in touch with one of our experienced loan officers, some of whom are also veterans, you can fill out our online application or call us at 866-569-8272.

Veterans Housing Assistance Program (VHAP)

Established by the Texas's Veterans Land Board (VLB) in 1983, the Veterans Housing Assistance Program (VHAP) is a state-run program that serves as a lender to eligible veterans in order to help them purchase a home at below-market interest rates.

The interest-rate does vary, with a half-point reduction for veterans who have a service-related disability rated by the VA as 30% or greater. All VHAP loans are fixed-rate, with a maximum lend amount of $453,100 and four term options: 15, 20, 25, or 30 years.

Though not a VA loan, at least not always, Texas's VHAP loans share a lot of similar benefits, including little or no money down. However, there are some important differences. For example, VHAP loans:

- Can only be used to purchase a home and cannot be used to refinance your existing home

- Require that the buyer lives in the home as their primary residence for at least 3 years

- Are only granted on homes that meet certain energy standards

Other qualifications and eligibility guidelines for both the home and the servicemember hoping to receive a loan can be found online.

Veterans Land Loan Program

The VLB also provides loans for veterans and servicemembers wishing to purchase land rather than a home. Similar to VHAP, veterans using this program can get below-market interest rates.

Veterans who qualify for a land loan can receive up to $150,000 with as little as 5% down. The land must be 100% located in the state of Texas and be at least one acre in size. Other requirements include that the property:

- Cannot be zoned for commercial use only

- Cannot have been owned by your spouse or yourself in the last 3 years

- Connects to a public road in a way that meets legal requirements

- Is accessible by a regular passenger vehicle, even in bad weather

- Is properly described and certified, either by a field note with the official seal and signature or a surveyor or an official copy of the subdivision plat

All other requirements for the Veterans Land Loan Program can be viewed online.

Veterans Home Improvement Program (VHIP)

Though not a loan program veterans can use to purchase a home, the Veterans Home Improvement Program (VHIP) is available to help them finance improvements and repairs to their existing home.

Like the VHAP and land loan programs, VHIP is administered through the state and offers below-market interest rates with an additional discount of 0.5% for veterans with a service-related disability of 30% or more. Currently there are two primary loan options:

- $50,000 with a 20-year term

- $10,000 with a 10-year term

A VHIP loan does not require a down payment; however, you will be required to pay other fees, including a title search fee, a flood certification fee, and other various closing costs.

The loan can be used to make a variety of improvements on your primary residence, including the correction of hazardous conditions, repairs to damage caused by a natural disaster, energy efficiency improvements, and more.

Veteran Housing Benefits

Texas State Veterans Home

If you're a veteran in Texas and need skilled nursing care, there are eight veterans homes to choose from. These are located in Tyler, Temple, McAllen, Amarillo, Bonham, Big Spring, El Paso, and Floresville.

Each veteran's cost to live there depends on their income. To be eligible, you'll need to have a discharge that was not dishonorable.

Veterans' spouses, including unmarried surviving spouses, may also be able to use this benefit. Additionally, Gold Star parents who are residents of Texas and within a certain age group may also qualify.

Disabled Veterans Property Tax Exemption

If you're a veteran and 100% disabled—or the surviving spouse of a disabled veteran—you are eligible to pay $0 in property taxes.

If the veteran has a disability rated by the VA between 10% and 90%, you can apply to have the assessed value of your house lowered by $5,000 to $12,000. This benefit also applies for the surviving spouse of a deceased disabled veterans.

In addition, you might be eligible for a reduction in taxes because of a homestead tax exemption in your county. Check with your county assessor by searching online with the name of your county and the words "county assessor."

Housing for Texas Heroes

These grants are not awarded directly to veterans. Instead, they are granted to housing organizations that assist veterans in Texas with their housing needs.

You can find out which organizations have received this grant each year on the Grants Awarded page of the Texas Veterans Commission website under the heading "Housing for Texas Heroes."

In general, these grants are given to organizations that:

- Help prevent veteran homelessness

- Assist with home modifications for veterans

- Supply housing support for veterans' families during medical treatment

Veteran Employment & Education Benefits

Employment Benefits

The Texas Veterans Commission works hard to veterans find new jobs. Their services include:

- Help creating a resume

- Job seeking and interview skills coaching

- Help translating military skills to civilians jobs

- Classes on how to search for jobs

- Referrals to jobs that match specific veterans' skills

- Career counseling

- Training referrals

- Help creating a step-by-step plan

Online Job Search Resources

Texas has online resources to help you search for jobs that are a good match for you. It's recommended that you register on WorkInTexas.com, which is focused on matching Texas job candidates with employers.

You can also use WorkInTexas-Veterans.Jobs, which allows you to use your military work specialty to search through related civilian jobs that could be suited to you. This site also recognizes the skills included in military occupation codes and gives their equivalents in civilian job skills.

Veterans Preference for State Employment

Veterans who receive the minimum score or higher on tests required by state agencies are entitled to have 10 points added to the score, with and additional 5 more points added for veterans with a disability.

State agencies who receive applications from qualified veterans are also required to interview at least one veteran if they are interviewing six or fewer candidates, or 20% if interviewing more than six, with the goal of state agencies having a 20% veteran workforce.

Though veterans preference won't guarantee you a job, it will help you during the interview process, if you're a qualified candidate.

Surviving spouses who have not remarried, and dependents of veterans killed during active duty, get the same preference.

Private Employers Searching for Veteran Employees

Certain Texas employers are interested in hiring veterans because of the skills and character traits you can bring to their organizations. They have their own practices of preferring veterans during the interview process.

Take a look at the list of these companies who have asked to be included. Because this list keeps growing, you can check back from time to time if none of them currently catch your attention.

While no company on this list is guaranteed to be hiring at the moment, it still serves as a great resource to help you in your job search.

Military Time Credit Towards State Retirement

If you work for the state of Texas, you can apply up to 60 months of your military service time toward state retirement by contributing to the state's retirement program.

Just use the number of months you were on active duty with the military and multiply that by the amount of your monthly retirement contribution. Then pay that resulting amount into your retirement program.

Education Benefits

The Veterans Education Program in Texas is in charge of approving programs that are made available by Chapters 30, 33, 35, 1606, and 1607 of the GI Bill. During this process, the Texas Veterans Commission makes sure that institutions are providing quality education to veterans.

Hazelwood Act

This is a Texas state benefit that gives eligible veterans, their dependent children, and spouses free tuition at state colleges for up to 150 credit hours. This benefit only includes tuition and most fees and does not include other expenses, books, or supplies.

To qualify, a veteran needs to meet these criteria:

- Is a current Texas resident

- Was a Texas resident when he or she joined the military

- Has an honorable discharge or "general discharge under honorable conditions" after at least 181 days of active duty

- Has exhausted VA education benefits

- Compliant with requirements for credit hours, academic progress, and GPA

- Current on any state student loan payments

In addition, there is a portion of the Hazelwood Act that benefits dependent children and spouses of deceased military servicemembers by also providing them with 50 free college credit hours. To qualify, the servicemember under whom they qualify must have:

- Had eligible active duty, National Guard, or Reservist service

- Been a Texas resident when they joined the military

- Died in the service or because of an injury or illness caused by their service, OR

- Are missing in action, OR

- Became unemployable because of a disability that resulted from their service

Spouses and children also must:

- Be residents of Texas

- Not have VA tuition benefits

- Be compliant with requirements of credit hours, GPA, and academic progress—but this doesn't apply to children of veterans who died because of their service, were killed in action, or are missing in action

Legacy Act

If you're eligible for payments from the Hazelwood Act and haven't used up your 150 hours, you can use your remaining hours on the education of a dependent child—only one child at a time—as long as the child is:

- Your biological child, adopted child, or stepchild—or you claimed him or her as a dependent during this or the previous tax year

- A resident of Texas

- Age 25 or younger on the first day of the term or semester

- Compliant with requirements for credit hours and academic progress

Other Veteran Benefits

Health Care Advocacy Program

Are you having trouble getting the health care services you need from the VA? There's a team of staff members from the Texas Veterans Commission spread all over Texas who can help you get:

- Lab & other health testing

- Appointments with physicians

- Help with pharmacies

- Necessary health care referrals

- Help with VA health care billing

- Referrals to services not given at VA facilities

Contact the team by calling 1-800-252-VETS (8387) or emailing hcap@tvc.texas.gov.

Veterans Mental Health Program

Staff at the Veterans Mental Health Program are available to help veterans, current servicemembers, and military families with issues related to mental health, especially trauma that our military personnel suffer in the service.

Many individuals who have been hurt by military trauma—even family members who weren't in the service—don't recognize that they need help and don't get access to help immediately when they need it.

Contact a team member right away if you need this type of assistance by calling 1-800-252-VETS (8387) or emailing vmhp@tvc.texas.gov.

General Assistance Grants

These grants are awarded to organizations that help veterans, not to veterans directly. To get the help you need, visit Texas's Grants Awarded page and look through the list of organizations for one near you. They provide services such as:

- Transportation

- Legal services (but not criminal defense)

- Some emergency assistance

- Education

- Job placement

- Family and child services

Free Driver's License for Disabled Veterans

You may be eligible to get a free Texas driver's license or state ID card if you are a veteran with an honorable discharge and at least a 60% service-related disability.

Disabled Veteran License Plates

If you are a veteran with a disability, you can get a Disabled Veteran license plate with the International Symbol of Access (ISA) on it. You can also choose to receive parking placards for those with disabilities. Either (or both) of these options will allow you to use parking spaces and areas designated for disabled persons.

To apply for your license plates, you'll need to fill out and submit application form VTR-615 to the office of your county tax assessor or collector. The application requires documentation of your eligibility and a check, money order, or cashier's check for the fee listed on the form.

The application form also allows you to choose different military emblems to customize your plates, but you cannot choose both a military emblem and the International Symbol of Access on the plates.

Hunting and Fishing Licenses

There are two primary types of free hunting and fishing licenses for veterans and servicemembers in Texas.

The first is the Disabled Veteran Super Combo license, which is available for veterans who have at least a 50% disability, or who can't use a foot or leg because of their service. To qualify for this license, the veteran does not even have to be a Texas resident.

The second is the Texas Resident Active Duty Military Super Combo license. This all-water fishing and hunting package license is available only to veterans who are Texas residents or servicemembers on active duty who have been stationed in Texas for the last six months.

Because both licenses are "Super Combo" licenses, they essentially function as all of the following:

- A resident hunting license

- A resident fishing license

- An archery state stamp endorsement

- A freshwater fishing state stamp endorsement

- A saltwater fishing with red drum state stamp endorsement

- An upland game bird state stamp endorsement

- A migratory game bird state stamp endorsement

Free State Parks Admission for Disabled Veterans

You can get into Texas's state parks for free if you're a veteran with at least a 60% disability or if you lost a lower extremity because of your service. You'll need to pick up a Texas Parklands Passport at any Texas state park and show one of the following:

- A letter from the VA showing your degree of disability

- A Texas veterans tax exemption letter

- A receipt for a "Disabled Veterans of Texas" license plate

Texas State Veterans Cemeteries

If you're a Texas veteran, there's no burial charge for you, your spouse, or your dependent children at any of the four Texas state veterans cemeteries located in Corpus Christi, Abilene, Mission, and Killeen.

Veteran Benefits Assistance

The Texas Veterans Commission provides services to veterans and their families and survivors in Texas. The Commission assists veterans in nine areas:

- Claims representation and counseling

- Communications and veterans outreach

- The Fund for Veterans' Assistance (FVA)

- Health care advocacy

- Veterans employment services

- Veterans education

- Veteran Entrepreneur Program (VEP)

- Veterans Mental Health Program (VMHP)

- Women Veterans Program

They coordinate their efforts with public and private organizations that also serve veterans. The staff hold themselves to a high standard of service and accountability toward Texas veterans, so contact them with any needs or questions you have.

About Low VA Rates

Low VA Rates has focused on VA loans for veterans, current military personnel, and their families ever since we first became a business.

So, if you're looking for VA loans in Texas, call Low VA Rates today at (866) 569-8272 for a FREE quote. Our experienced, professional staff will help you determine your eligibility, work with you to get your Certificate of Eligibility from the VA, if you need, and find the best loan for you.

Or, if you prefer, you can start the process by applying through our online application.

© 2026 Low VA Rates, LLC™.

All Rights Reserved. Low VA Rates, LLC is not affiliated with any U.S. Government Agency nor do we represent any of them. Corporate Address: 384 South 400 West, Suite 100, Lindon, UT 84042, 801-341-7000. VA ID 979752000 FHA ID 00206 Alaska Mortgage Broker/Lender License No. AK-1109426; Arizona Mortgage Banker License #0926340; Licensed by the Department of Financial Protection and Innovation under the California Finance Lenders Act License #603L038; Licensed by the Delaware State Banking Commission License #018115; Georgia Residential Mortgage Licensee License #40217; Licensed by the New Jersey Department of Banking and Insurance, Ohio Mortgage Loan Act Certificate of Registration #RM-501937.000; Oregon Mortgage Lending License # ML-5266; Rhode Island Licensed Mortgage Lender License #20143026LL; Texas License LOCATED at 201 S Lakeline Blvd., Ste 901, Cedar Park, TX 78613; EAH032221 NMLS ID# 1109426 NMLS Consumer Access

© 2026 Low VA Rates, LLC™.

All Rights Reserved. Low VA Rates, LLC is not affiliated with any U.S. Government Agency nor do we represent any of them. Corporate Address: 384 South 400 West, Suite 100, Lindon, UT 84042, 801-341-7000. VA ID 979752000 FHA ID 00206 Alaska Mortgage Broker/Lender License No. AK-1109426; Arizona Mortgage Banker License #0926340; Licensed by the Department of Financial Protection and Innovation under the California Finance Lenders Act License #603L038; Licensed by the Delaware State Banking Commission License #018115; Georgia Residential Mortgage Licensee License #40217; Licensed by the New Jersey Department of Banking and Insurance, Ohio Mortgage Loan Act Certificate of Registration #RM-501937.000; Oregon Mortgage Lending License # ML-5266; Rhode Island Licensed Mortgage Lender License #20143026LL; Texas License LOCATED at 201 S Lakeline Blvd., Ste 901, Cedar Park, TX 78613; EAH032221 NMLS ID# 1109426 NMLS Consumer Access